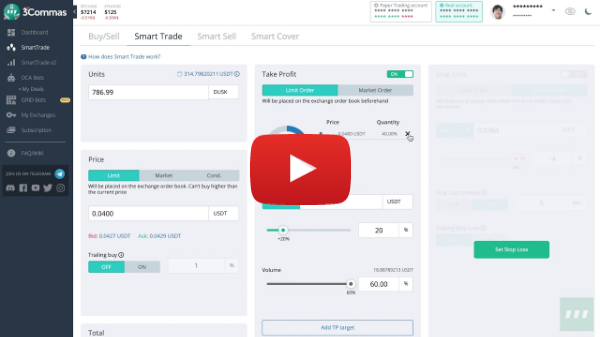

| Step 1: Choose your exchange.

Step 2: Choose a trading pair asset that can be traded for each other on an exchange. For example Bitcoin/Litecoin (BTC/LTC) and Ethereum/Bitcoin Cash (ETH/BCH). Trading pairs lets you compare costs between different cryptocurrencies.

Step 3: Select Trading View to see how the trading chart for the cryptocurrency you want to trade populates. Select the indicators you'd like to see, including Bollinger bands, Accumulation/Distribution and more. Don't worry if you're not experienced with these yet. You'll get there!

Step 4: Don't forget to review the order book, which is the ledger containing all outstanding orders (instructions from traders to buy or sell crypto). An order to buy is called a "bid" and an order to sell is called an "ask." Bids and asks are paired up as soon as their requirements are fulfilled, resulting in a trade.

Step 5: Choose your buy price. The trading chart gives you insights into historical levels of support and resistance, so you'll have a visual idea of what could be a good buy price.

Pro tip - avoid round numbers. Everyone likes round numbers and it can be difficult to get a buy order executed when there is a high volume of orders being triggered at that price.

Step 6: Select how much you want to buy, either in units or a percentage of your portfolio.

Step 7: Decide if you want to activate trailing buy. Once the price hits where you want to buy, maybe that price will keep going down. You can specify a trailing buy at a set percentage, and for every increment that the asset price goes down, your buy price also drops by that same percent. That allows you to purchase the asset at a cheaper price when it starts to go back up. The result? you get the lowest price possible!

Step 8: Select your desired sell price to take profits. Choose market order or limit order. Market sells to the highest bidder at that moment, and with limit order, you decide what price you want to sell, and you're waiting for that price.

Step 9: Create trade.

If you've gotten this far, I want to offer you my sincere congratulations. A lot of people get very excited about trading, and then when it comes time to execute, they sit back and watch everyone else take all the profits.

This is your time, and the entire 3Commas team is here to support you. If you have any questions at all, please feel free to reach out to us at support@3commas.io.

Good luck on your first trade!

|

Komentáře

Okomentovat